New Jersey and New York, along with Connecticut, sued the Trump administration on Wednesday, challenging Internal Revenue Service rules that outlaw certain workarounds to the cap on state and local tax deductions.

The 2017 federal tax law imposed a $10,000 cap on state and local tax deductions, which officials in high tax states like New York and New Jersey say disproportionately impacts their residents.

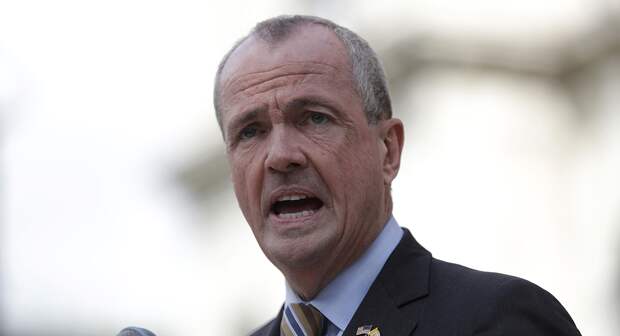

New York Gov. Andrew Cuomo, New Jersey Gov. Phil Murphy and others have argued this was an intentional act by Republicans in Washington to try to pay for other parts of the sweeping legislation by targeting blue-leaning states.At a press conference in South Orange, N.J., announcing the lawsuit, Murphy described the IRS rule as a “gut punch” to middle class families in higher tax blue states.

“It was a complete and utter politicization of the tax code,” Murphy, a Democrat, said. “New Jersey is not looking for special treatment for its taxpayers, we are just looking for equal treatment.”

A number of states have tried to circumvent — and ultimately unwind — the cap, with mixed results. Cuomo has vowed a “nationwide campaign” to undo the so-called SALT cap and has traveled to Washington multiple times to lobby President Donald Trump and members of Congress on the issue.

Wednesday‘s lawsuit, filed in the Southern District of New York, argues the IRS is making a “radical break with historical precedent” and seeks an injunction. Not only is the IRS rule arbitrary and outside of the agency’s statutory authority, the lawsuit alleges, it is also a violation of the federal Administrative Procedures Act, which governs the process by which federal agencies develop and issue regulations.

“The final IRS rule flies in the face of a century of federal tax law that says state choices to provide tax incentives for charitable donations do not affect the federal deductibility of those gifts,” Cuomo said in a statement. “It will — for the first time and solely in the name of retribution — require taxpayers to subtract the value of state or local tax credits from their federal charitable deduction.”

In addition to the IRS, the lawsuit names Treasury Secretary Steven Mnuchin as a defendant. According to the lawsuit, Mnuchin said the cap was intended to “send a message” to states like New Jersey and New York to change their tax policies.

The cap appears to have altered taxpayer behavior, complicating budget outlooks in many of high-tax states. However, it does not appear to have had the calamitous impact on revenue in its first full year that some had feared.

New York, New Jersey and Connecticut were among four states — Maryland being the other — that filed a lawsuit in 2018 challenging the cap itself. The Trump administration has sought to toss that lawsuit.

In the meantime, the four states have also sought to help residents skirt the cap by permitting them to pay much of their state and local taxes to a government-blessed charitable reserve fund and then claim that contribution from their federal tax bill. The final IRS rule, which is set to take effect in August but will be retroactive to June effectively prohibits such arrangements.

Rep. Josh Gottheimer (D-N.J.), who has been a vocal proponent of trying to overturn the cap, praised the lawsuit during a press call Wednesday afternoon. Gotthheimer has introduced resolutions in Congress to prevent the IRS from enacting this policy.

“I’ve been hammering away on this,” he said. “The more pressure the better, I think there is a real opportunity now to tell the IRS that they’ve overreached."

A separate lawsuit filed by the village of Scarsdale, New York, on behalf of a coterie of other counties, municipalities and local school districts was also filed Wednesday. That suit argues the IRS regulations will cause “irreparable harm” to the charitable reserve funds established under state law enacted in the wake of the federal tax cut.

“In trying to satisfy the whims of this administration without running afoul of powerful interests, the IRS regulations strayed far from the law that they were supposed to interpret,” said New York State Assemblywoman Amy Paulin (D-Scarsdale), who sponsored the legislation authorizing these charitable contributions in New York. “These regulations will cause real harm for villages like Scarsdale and taxpayers across the country struggling to remain in the communities they fell in love with and to send their children to the same nurturing, high-quality schools.”

The second lawsuit argues that money has stopped going into Scarsdale’s charitable fund since the rule was finalized, thereby depriving it of its share of revenue and is “directly attributable to Defendants’ unlawful regulatory action.” The fund received $500,000 in 2018, of which $25,000 went to the village, according to the complaint.

Article originally published on POLITICO Magazine